What is the Difference Between Income Protection Insurance & Life Insurance for Dads

In contrast to life insurance, which is paid out to your loved ones after your death, income protection insurance pays out to you while you are still working.

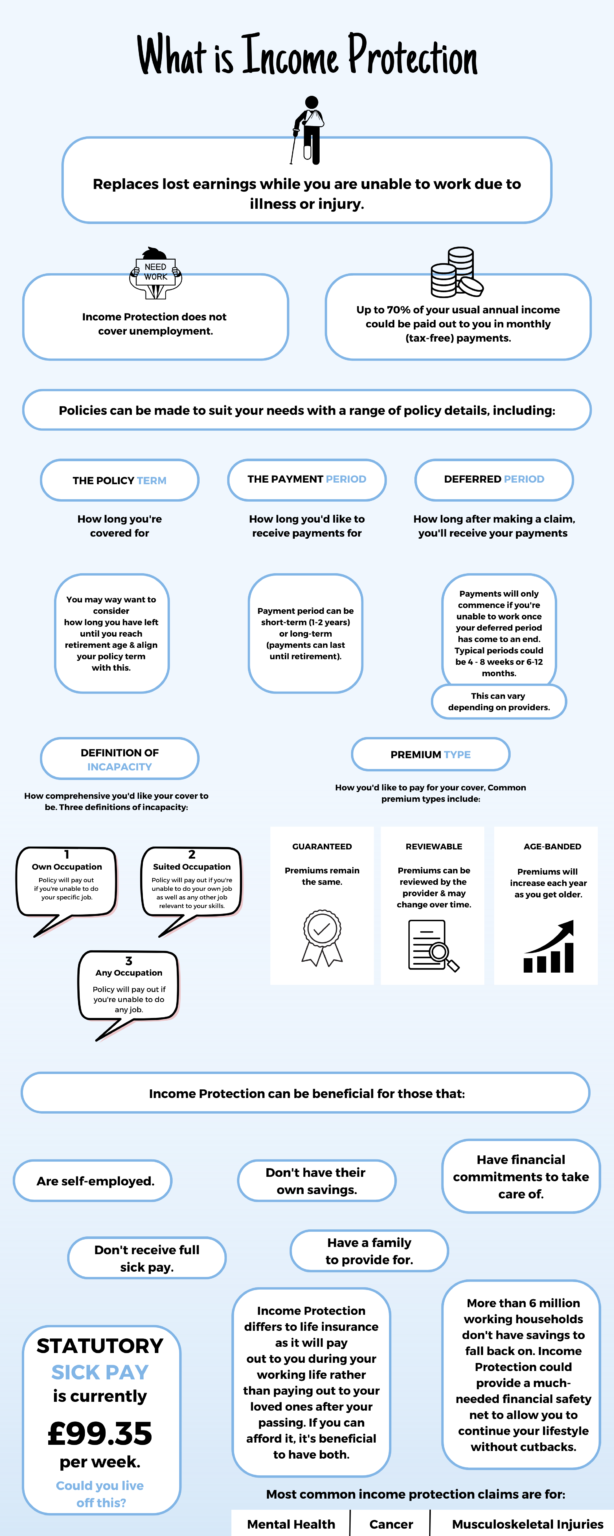

Income protection – Aids in replacing lost wages if illness or accident prevents you from working.

Life insurance – Gives surviving family members a lump sum payment to maintain their standard of living after your passing.

Income Protection Insurance

- Can pay out to you if you can’t work due to illness or injury.

- Pays out in monthly payments (to mimic an income).

- Cover amount (or benefit amount) can be up to 70% of your usual earnings.

- You can choose between short term or long term cover (this refers to how long you’ll receive payments for).

Life Insurance

- Can pay out to your loved ones after your passing.

- Pays out in one lump sum payment.

- Cover amount (or sum assured) is decided by you at the point of application and can be up to £1,000,000.

- You can choose between term-based or whole of life cover.

Despite the fact that these plans provide coverage for a variety of situations, 39% of consumers said they would not purchase income protection if they already had a life insurance policy in place[1].

However, having both in place as a dad might be advantageous (if your budget permits) to offer you and your family a comprehensive protection solution should the unexpected occur.

You may compare life insurance and income protection insurance quotes for free as a dad with the aid of Daddy Insurance.

In this manner, you can discuss your requirements with a specialist and be given all your selections to assist you in locating the ideal cover solution.

Whether it be life insurance, income protection insurance, or both. So why not reach out to us?

Continue reading this comprehensive income protection vs. life insurance comparison guide to learn which option is best for you.

Do I Need Income Protection Insurance or Life Insurance

Your specific needs will determine whether you require life insurance or income protection insurance.

It may be advantageous to get both policies at once because they will protect you for various situations (if your budget allows).

A life insurance policy to protect your loved ones after your death and an income protection insurance policy to safeguard you while you’re working.

Who Needs Income Protection?

Income protection insurance can help anyone who works by replacing lost income. However, it can be particularly beneficial for:

- Self-employed workers who don’t receive sick pay.

- Those who don’t receive a sick pay scheme from an employer.

- Those who don’t have personal savings to fall back on.

- Those with financial commitments who want to ensure they can keep up with payments no matter what.

- Those with a family who want to protect their daily living costs.

Who Needs Life Insurance?

Life insurance can alleviate loved ones from financial stress after your passing. It can be beneficial for:

- Those with a family who want to allow them to continue their current lifestyle.

- Those with a mortgage who want to allow their surviving partner or family to remain in the family home.

- Those with shared assets to allow the remaining partner to keep up with payments.

- Those who want to provide an inheritance to their children or grandchildren.

Life Insurance, Critical Illness Cover & Income Protection Insurance for Dads

These policies are often talked about together, but there are some key differences you should be aware of:

Life Insurance – Pays out a lump sum to loved ones upon your passing.

Critical Illness Cover – Can be taken out as a standalone policy or added to a life insurance policy for an additional cost. It will provide you with a lump sum pay out if you’re diagnosed with a serious illness (that’s listed within your policy).

Income Protection – Will pay out a percentage of your income if you’re unable to work due to sickness or accident.

While life insurance differs as it pays out upon your passing, income protection insurance and critical illness cover are similar in the fact that they pay out if you experience a period of serious illness.

While they have some similarities, the two options are quite different. Critical illness cover will pay out to you in a lump sum, whereas income protection insurance will pay out in monthly instalments to mimic an income.

How Does Life Insurance Work?

- Your loved ones may get a cash lump sum from your life insurance policy after your passing.

- They will be able to handle important financial obligations like rent or mortgage payments (so they may stay in the family home), living expenses, the price of your funeral, and much more thanks to this.

- There are several different insurance options available, including whole life insurance, which will cover you for the rest of your life, and term-based coverage, which will give coverage for a set period of time.

- You can pick a policy length that suits your requirements. With a term-based coverage, this may last up to 40 years, or with whole-life insurance, it could last the rest of your life.

- To keep your coverage active, a monthly charge is required. Your personal circumstances (such as age, medical history, smoking status, etc.) and the specifics of the policy will affect the cost.

- Additionally, you have the option of selecting the amount you want to give to your loved ones. The most that might be given is £1,000,000. This, however, is probably much more than most people actually need.

- Your loved ones may file a claim with your provider if you pass away while your policy is in force. The proceeds of the policy will be distributed following receipt of a valid claim.

Can You Get Life Insurance & Income Protection Insurance Simultaneously

Yes, you can take out a life insurance and income protection policy simultaneously.

While you can’t add income protection to a life insurance policy, if your budget allows, you can take out both policies separately at the same time.

In the event that you become too ill or injured to work, income protection could help you to:

- Cover mortgage payments or ongoing rent.

- Pay for household bills (gas, electric, water, broadband etc).

- Pay for childcare.

- Cover transportation costs.

- Keep up with loan or debt payments (credit cards or car finance payments).

- Do the weekly food shop.

- Cover leisure costs.

In the event of your passing, a life insurance pay out could be used by your loved ones to:

- Cover mortgage payments or ongoing rent.

- Cover the cost of your funeral.

- Pay for additional childcare costs.

- Cover daily living costs and any future living costs.

- Pay off outstanding debts in your name.

- Receive an inheritance to spend as they wish.

What is the Cost of Life Insurance vs Income Protection Insurance

Both life insurance and income protection can be secured with Daddy Insurance.

However, with both policy types, the exact price you pay will depend on certain key information.

This includes both details about your circumstances and your chosen policy details.

Details taken into consideration to calculate your income protection premium include:

- Age.

- Health and wellbeing.

- Smoking status.

- Occupation.

- Length of payment period.

- Length of deferred period.

- Definition of incapacity.

- Premium payment type.

Details taken into consideration to calculate your life insurance premium include:

- Age.

- Health and wellbeing.

- Medical history.

- Smoking status.

- BMI.

- Policy type.

- Level of cover.

- Length of term.

What are the Pros & Cons of Income Protection Insurance

The main advantage of income protection is that it may be able to assist you in making up for missed wages during times of illness or injury.

Up to 70% of your regular income may be disbursed (on a monthly basis), which may be used for any purpose.

You no longer need to use your funds, make sacrifices in your daily life, or rely on others.

Pros

- Can help you to replace lost income if you become incapacitated and can’t earn your usual.

- Up to 70% of your income can be paid out.

- Pays out in monthly instalments to help with budgeting.

- Payments aren’t tied to a specific financial commitment so you can spend them as you wish.

- Can be possible to make multiple claims throughout the policy lifetime.

Cons

- Won’t pay out to you if you pass away (although some policies may offer a small lump sum if you pass away while your policy is active).

- Won’t pay out the full amount of your income.

- Monthly payment may not be sufficient to cover larger expenses.

- If you have a high-risk occupation (or if other high-risk factors are identified) you may pay more for your cover.

What are the Pros & Cons of Life Insurance

The main advantage of life insurance is that it can give you financial security for your loved ones in the event of your demise.

Adjusting one’s lifestyle to fit a new budget can be difficult, particularly at a difficult period.

Mortgage or rent payments, as well as other everyday living expenses, may be covered by a life insurance payout, allowing your family to maintain their standard of living.

Pros

- Can provide essential financial support when loves ones need it most.

- A lump sum pay out will be made which can help to cover large expenses (such as a mortgage, funeral costs and/or living costs).

- There are a variety of policies available (such as term life insurance, whole of life insurance and over 50 life insurance).

- Extra safety nets of protection can be added to your policy (such as terminal illness cover or critical illness cover).

Cons

- Loved ones will only receive a payment if you pass away while your policy is active.

- It can be possible to outlive the term of your policy (meaning no pay out is made).

- Can be possible to pay more into the policy (for example, if you take out whole of life insurance at a young age).

- You may experience higher premiums if high risk factors are identified during the application.

Compare Income Protection Insurance & Life Insurance Quotes for Free

One policy isn’t necessarily better than the other and it can be possible to take out both income protection and life insurance simultaneously with Daddy Insurance.

Speaking to an expert is the best way to determine the best option for you.

The team at Daddy Insurance can help you compare income protection insurance and life insurance quotes from our panel of insurance providers, while answering any questions you may have.

So why not get in touch to find your ideal cover solution? Quotes are personalised, without obligation and fee-free.