Do I Need Life Insurance As A Dad?

Although it is not required by law, having life insurance as a dad could significantly benefit your loved ones in a trying situation.

Learn about life insurance’s benefits, who might need it, when you might want to get it, and what the best life insurance for dads is.

After you pass away, life insurance could provide your loved ones with financial support, enabling them to maintain a roof over their heads and food on the table. Therefore, it’s crucial to think about if you have someone who depends on you financially, such as a spouse, children, or elderly relative.

Even if you are not the family’s primary provider, you should consider whether the loss of your assistance with caring for the home and children might have a negative financial impact.

Yes, life insurance is something that dads who stay at home with their children should really consider. When families determine their insurance requirements, the genuine “worth” of stay-at-home dads is frequently disregarded. The fact that stay-at-home dads aren’t employed doesn’t diminish their importance to the family or eliminate the need for life insurance in the UK.

Dads who stay at home put in a lot of unpaid labour. Basically, it’s a full-time job. Involvement and care for a child or children, as well as domestic tasks like cooking and cleaning, all take up time.

Because of this, it’s crucial to consider who would handle all these tasks if you were unable to. Or, in the unlikely event that your partner passed away, you would be the primary provider of income.

It could be worthwhile to think about how you can fit in these tasks in addition to going to work. Additionally, keep in mind that paying someone else to accomplish things with your existing income could be very expensive.

Your loved ones would receive a life insurance payment upon the death of the parent if life insurance were to be purchased to cover them. Usually, a single payment is made for this.

This serves as a safety net for your finances and may enable you to pay off outstanding debts like your mortgage and keep up with your payments. Additionally, it can allow the wage earner who is still around to work less, take a break from work, or pay for childcare.

It’s crucial to purchase the appropriate amount of life insurance. You should calculate how much money you would need to support your family in the event of a different future. Daddy Insurance can help you calculate how much life insurance you may need as a dad. Life insurance for dads made easy with Daddy Insurance!

Life insurance for young dads is essential and benefits your family. The knowledge that you’ve taken all reasonable precautions to protect your children might give you peace of mind. Unfortunately, no one can predict what will happen in the future, so even if you could be healthy right now, you never know when things could unexpectedly change.

Life insurance for young dads is generally less expensive as you are younger. You are a low risk to insurers, which is why. Most of the time, your premiums are set, so even as you age, the price of your life insurance won’t rise.

As a young dad, it’s critical to consider how much coverage you’d need and for how long. You can choose how much protection you want from purchasing a life insurance policy by considering how many years it will take your kids to become more financially independent as well as how long your mortgage will last.

As a dad, life insurance can provide great financial protection for your children. However, there are several types of life insurance options to consider:

Pays out a predetermined amount to your beneficiaries over an agreed-upon time frame (for example, 30 years). The amount of coverage is determined by the monthly premium you’re willing to pay.

This type of coverage likewise lasts for a set amount of time, but the payment is variable. The payout gets smaller over time as the policy continues. Therefore, the payout would be more if you passed away after five years than if you did after twenty. This kind of life insurance is frequently used to pay off a repayment mortgage because the potential payout decreases as the sum of the mortgage increases. As it is typically the least expensive life insurance and offers the most protection while the child is most vulnerable, this could be the best life insurance for young dads.

Because it delivers a guaranteed payout, whole life insurance is typically the most expensive form of protection. You will have a set payout for the rest of your life as long as you make your monthly payments on time.

Joint life insurance protects both of you if you’re married or in a similar committed relationship, but only makes one payout. This is intended to give the surviving parent or partner—or whoever that is—financial security. Even though you only receive one payout, this is less expensive than insuring you both separately.

If you’re a single dad, your child can be financially solely dependent on you. This justifies giving life insurance’s protection some serious thought. If you choose the correct life insurance plan, you’ll be able to rest easy knowing that, in the event of your passing, your child will be taken care of financially.

You might want to think about creating a trust for your life insurance coverage. This will prevent the insurance payout from being used to settle any unpaid obligations you may have and will segregate the policy payout from the remainder of your estate (which is liable to inheritance tax). Because the insurance policy won’t have to wait for probate, it might also pay out sooner. The legal procedure of assessing your estate and distributing money after your death is called probate. This can require some time.

Alternatives to Life Insurance for Dads

For dads there are various alternatives to consider if you decide that a life insurance policy isn’t the best option for you:

Critical Illness Cover for dads is sometimes a life insurance policy add-on but can also be purchased alone. If you are told that you have a serious illness or injury, it will pay out. The money may be used to undertake critical house improvements or to replace potential lost income.

If you’re concerned that your child or partner would lose their home if you passed away, mortgage insurance is made to pay off any remaining mortgage obligation.

Income Protection Insurance can provide a tax-free income to cover your outgoings if you’re unable to work due to illness or injury.

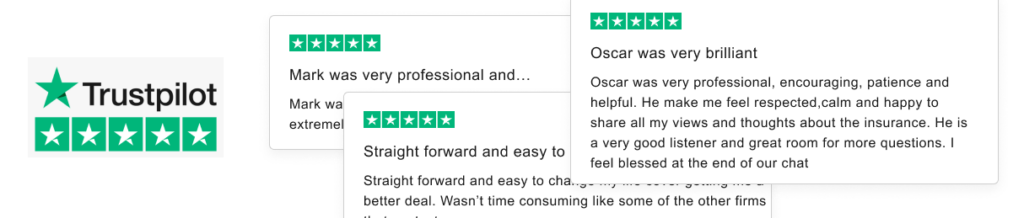

Dads, compare the best life insurance for dads in the UK using Daddy Insurance. Daddy Insurance provides free life insurance quotes that are tailored to dads to help them find the best life insurance policies at the best prices. Daddy Insurance also provides free quotes for critical illness cover, income protection insurance, mortgage protection & more!

MUMS

Don’t fret mums, we have a whole website dedicated for you. MummyInsurance.com provides free life insurance quotes tailored to mums.